what happens to irs debt after 10 years

In this event the. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

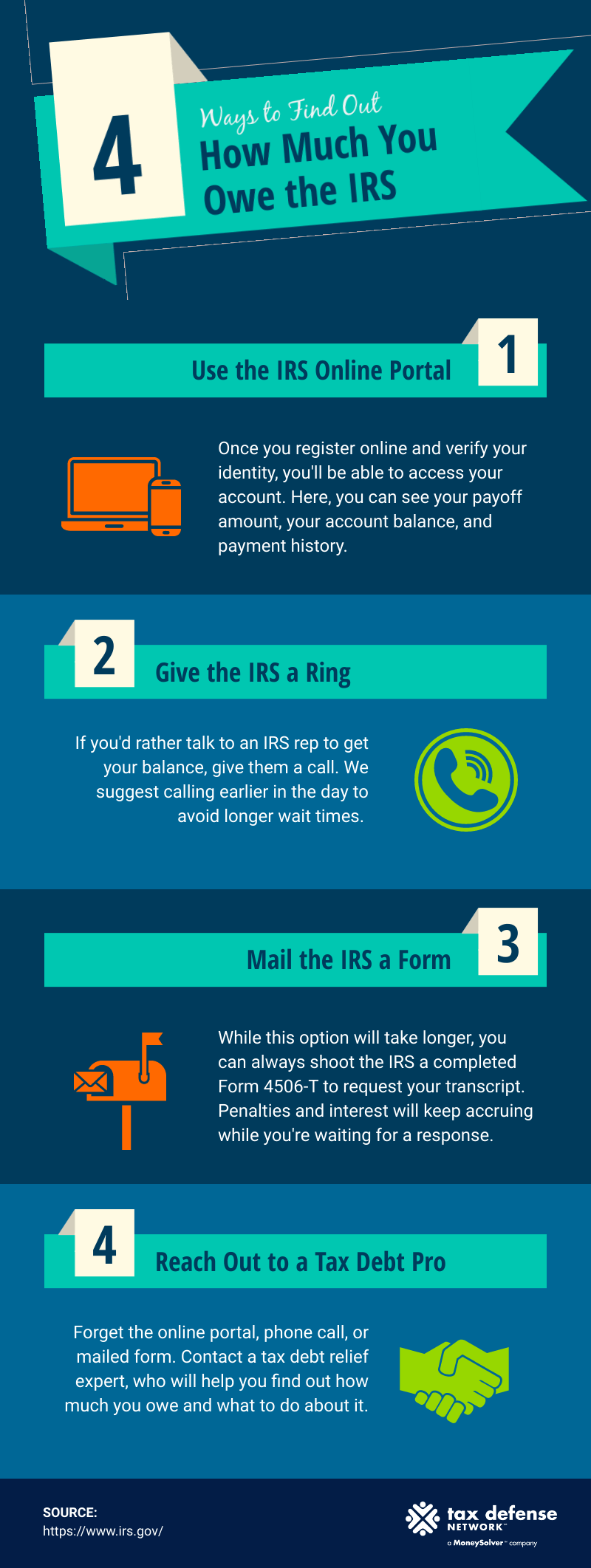

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

To accomplish this on.

. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After that time has expired the obligation is entirely wiped clean and removed. If you prove to the IRS this is the first time you have been in a.

465 47 votes In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. What happens after 10 years of owing the IRS. The IRS cant try and collect on an IRS balance due after 10 years.

The reason is there may. This is called the 10 Year. Ten years is a long time to maintain an outstanding tax balance with the IRS.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After this 10-year period or statute. Under certain circumstances the IRS will forgive tax debtors after 10 years.

This is called the. Limitations can be suspended. After that the debt is erased from your books and the IRS cancels it.

You should prepare to sign paperwork allowing the IRS to collect the debt past ten years. This is called a 10. What happens to a federal tax lien after 10 years.

However some crucial exceptions may apply. The day the tax debt expires is often referred to as the Collection Statute Expiration Date or CSED. Some tax debts will expire 10 years after.

As already hinted at the statute of limitations on IRS debt is 10 years. Will the IRS remove a tax lien after 10 years. You can also use ChildTaxCreditgov to file a 2021 tax return and.

Does the IRS forgive tax debt after 10 years. After that the debt is wiped clean from its books and the IRS writes it off. For some that could involve prolonged liens on all property and potential seizure after a levy has been.

The rule does say however that they cant extend beyond an additional six years. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes.

After that the debt is wiped clean from its books and the. This is called the 10. The IRS considered the pending installment agreement in effect for the whole time period 5 years and now the IRS has 15 years to collect the tax debt.

As a general rule of thumb the IRS has a ten-year statute of limitations on IRS collections. This means that under normal circumstances the IRS can no longer pursue collections action against. After that the debt is wiped clean from its books and the IRS writes it off.

After that the debt is wiped clean from its books and the IRS writes it off. After that the debt is wiped clean from its books and the IRS writes. This is called the.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. If this is the first time youve owed the IRS money you can request a first-time abatement. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

But your 10-year period may not be the same time period as the IRS 10-year period. The IRS is keeping its free filing tool open for an extra month this year extending the deadline to Nov. After the 10 year statute of limitations on collections expires the IRS is required to release the lien.

After that the debt is wiped clean from its books and the IRS writes it off. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Its not exactly forgiveness but similar.

If the statutory period for collection has not been extended.

Can The Irs Collect On A 10 Year Old Tax Debt

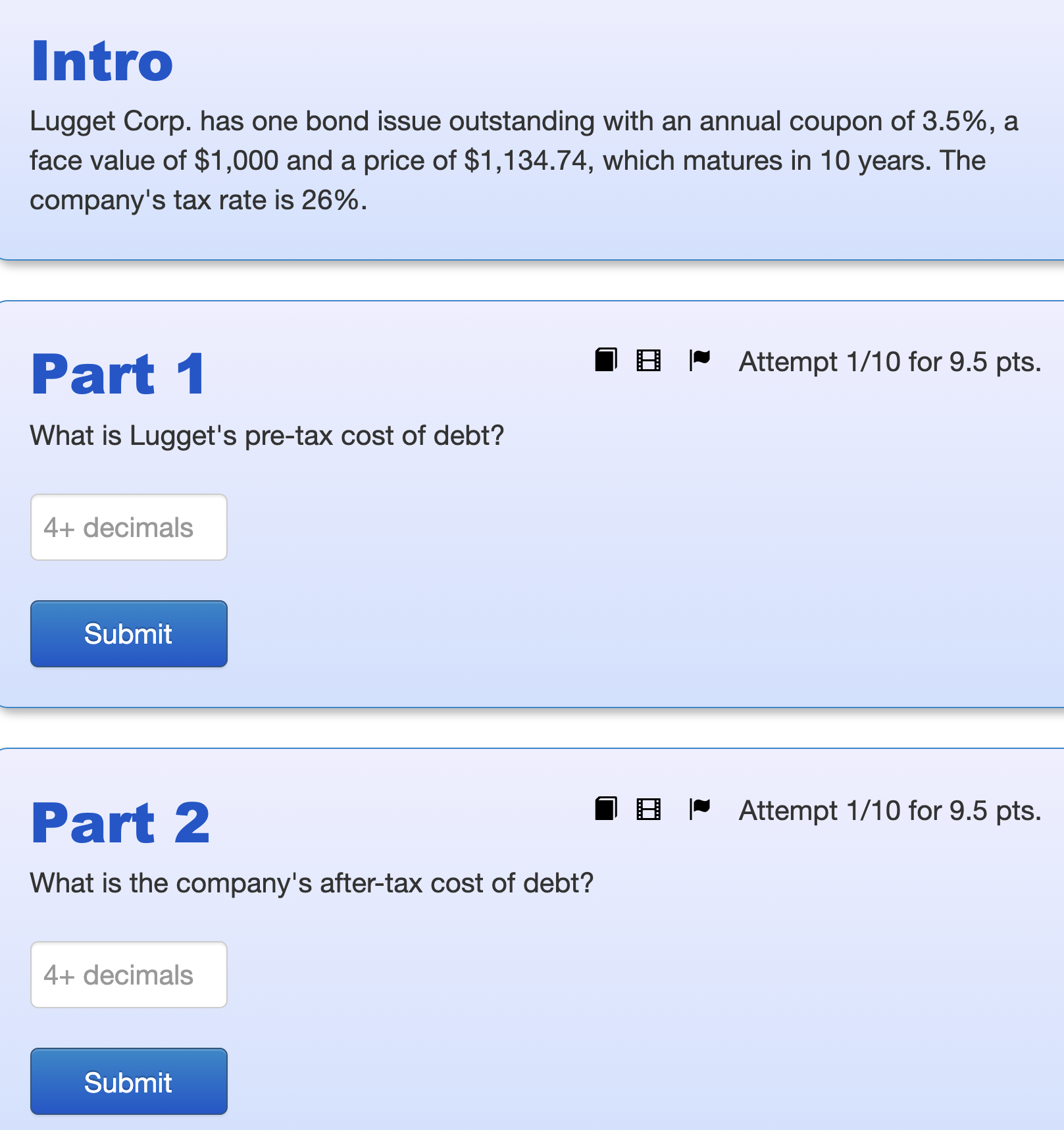

Solved Intro Lugget Corp Has One Bond Issue Outstanding Chegg Com

How Long Can The Irs Try To Collect A Debt

Owe Taxes To The Irs What To Do When You Can T Pay

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Can Irs Collect After 10 Years 10 Year Statute Of Limitations Irs

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Does Irs Debt Go Away Yes But It S Not That Simple Lendedu

Tax Changes For 2022 Kiplinger

National Tax Resolutions Attorney Blog Silver Tax Group

Irs Statute Of Limitations Can They Collect Tax Debt After 10 Years

Does The Irs Forgive Tax Liability After 10 Years Omni Tax Help

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Florida Tax Debt Relief Irs Help Tax Center Usa Tax Problem Relief

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Tax Debt Relief Irs Programs Signs Of A Scam

Tax Refunds In America And Their Hidden Cost 2020 Edition

How To Remove A Tax Lien From Public Record Community Tax

Irs Debt Relief Dallas Bankruptcy Lawyer Allmand Law Firm Pllc